Impacts and outcomes of the Government's tax reform program

Since 2012, the ACT Government has been undertaking a significant tax reform agenda.

The reform has changed how tax is collected in the ACT.

The aim is to create a more reliable revenue source through general rates to fund our essential services such as hospitals, schools, transport and city maintenance. Inefficient and unfair taxes such as stamp duty and insurance duty will continue to be reduced.

A more stable tax system makes it easier to respond to crises, such as the bushfires and COVID-19 pandemic.

The reform is designed to be revenue neutral, so tax revenue is not being increased through the reform process.

In 2019, the government commissioned an analysis of the tax reform program to assess progress across its first seven years. As the first jurisdiction in Australia to implement such a progressive reform, the Government wanted to understand the impact of the program on the ACT community and economy.

The analysis was overseen by a Tax Reform Advisory Group comprised of the Deputy Under Treasurer Mr Stephen Miners, and three independent external advisors: Professor Robert Breunig, Dr Richard Denniss and Professor Robert Tanton. This Advisory Group oversaw the detailed analysis of the impact and outcomes of the program on:

- revenue neutrality, examined by Treasury;

- the ACT economy, examined by the Centre of Policy Studies (COPS) at Victoria University;

- households across the distribution, examined by the National Centre for Social and Economic Modelling (NATSEM) at the University of Canberra;

- residential property prices and turnover, examined by both the COPS and the Tax and Transfer Policy Institute (TTPI) at the Australia National University;

- the rental market, examined by the TTPI; and

- progressivity and equity, examined by NATSEM.

Publication of the analysis was delayed as the Government responded to the COVID-19 crisis.

Achievements of tax reform from 2012-13 to 2020-21

- The first and only state or territory to abolish Insurance Duty – removing a duty as high as 10% from insurance products. This saves a household that spends $4,000 on insurance products $400 a year.

- Reduced a significant barrier to home ownership – the purchaser of a $500,000 property in 2020-21 paid $9,100 or 44 per cent less in stamp duty than prior to tax reform, and the purchaser of a $750,000 property in 2020-21 paid $12,675 or 36 per cent less in stamp duty than prior to tax reform.

- Removed commercial land tax – simplified the commercial land tax system.

- Increased the stamp duty free threshold for commercial properties to $1.5 million – around 80 per cent of commercial property transactions now pay zero stamp duty.

- During the tax reform period we have also increased the payroll tax threshold from $1.5 million to $2 million – the highest in the country with less than 10 per cent of businesses in the Territory being liable for payroll tax.

Key finding of tax reform analysis

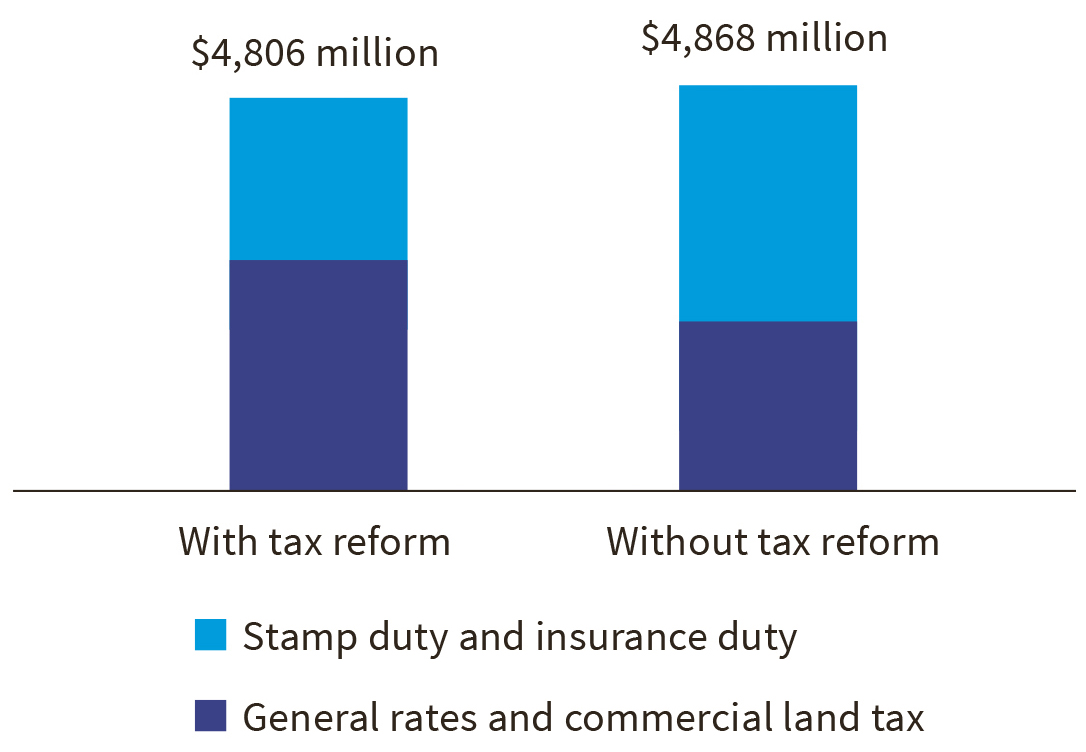

Revenue neutrality

The tax reform program has been broadly revenue neutral over the first seven years. The Government has collected slightly less cumulative total revenue ($62 million) than would have been collected in the absence of tax reform. The increase in cumulative general rates of $793 million is more than offset by the cumulative revenue forgone from stamp duty and insurance duty of $855 million.

Cumulative total revenue from 2012 to 2019

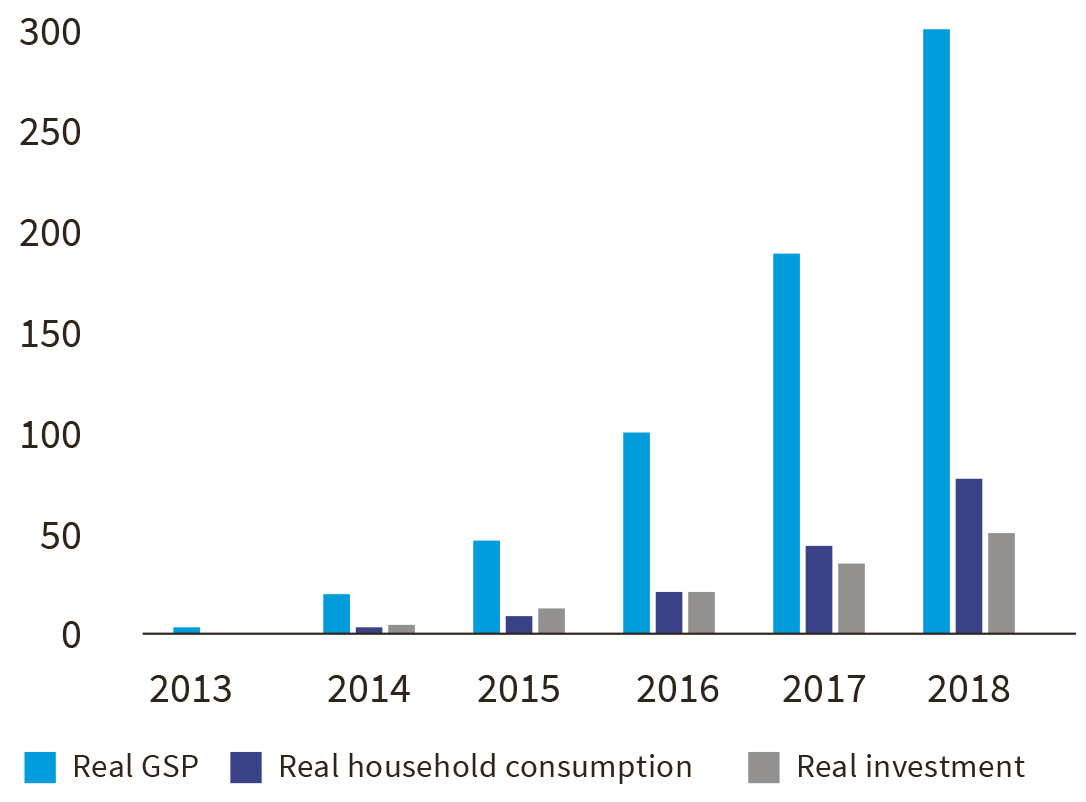

Economic impacts

Tax reform has increased economic efficiency and resulted in economic growth. Real GSP, household consumption and investment have increased in every year, with the increases growing over time. Over the reform period:

- real GSP has increased by $302 million (0.11 per cent on average);

- real household consumption has increased by $78 million (0.07 per cent on average);

- real investment has increased by $52 million (0.11 per cent on average);

- employment has increased by 0.11 per cent on average; and

- real wages have increased by 0.05 per cent on average.

Cumulative increase in key economic indicators ($ million)

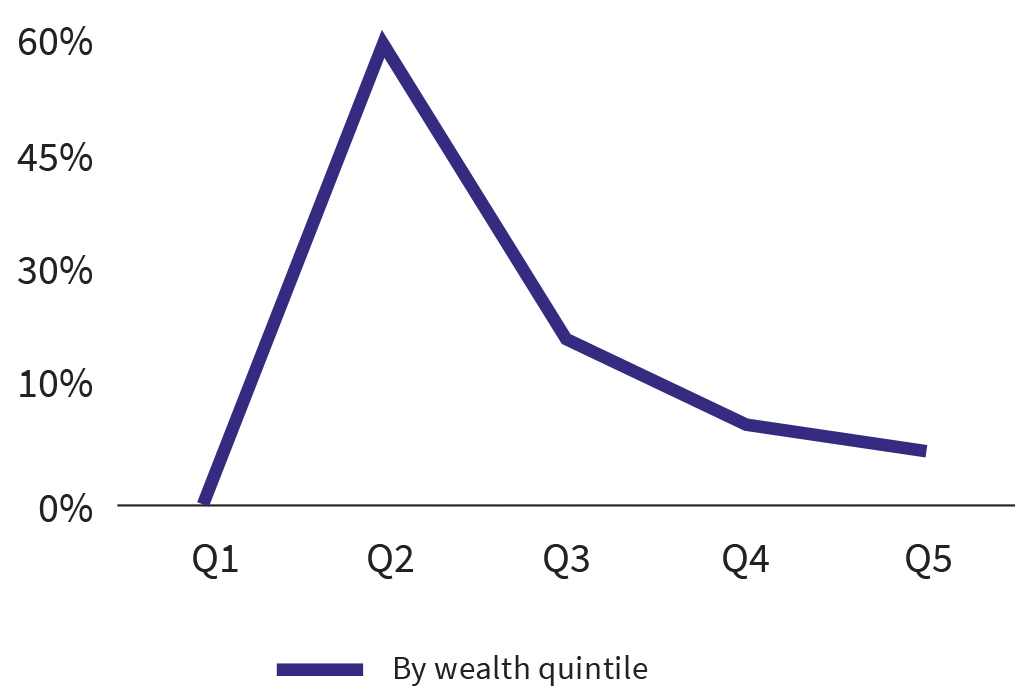

Distributional impacts

Tax reform has particularly benefited first-home buyers (including female headed households that are new-homeowners) and lower wealth households, enabling more to purchase properties.

While not explored in the analysis, the Government is delivering the largest per capita investment in public housing of any jurisdiction in Australia. The Government is committed to supporting lower wealth and income households in purchasing a home through the Affordable Home Purchase Scheme and the Land Rent Scheme.

Increase in property purchases as a percentage of the total increase in property purchases

The property and rental market

Property prices and turnover have increased as a result of tax reform.

It is also possible that rents have decreased and the supply of rental properties has increased, with lower rental quintiles likely to have experienced larger percentage decreases in rents.

Changes in economic activity and rental market

| Effect on: | Increase/Decrease |

|---|---|

| Residential property turnover | Increase |

| Residential property price | Increase |

| Rental prices | Decrease |

| Rental supply | Increase |

Progressivity and equity - stamp duty

Stamp duty is more progressive as a result of tax reform, with lower income households paying a lower proportion of total stamp duty revenue.

More households in the second wealth quintile can now afford to buy due to stamp duty reductions, therefore these households are paying a higher proportion of total stamp duty revenue.

Change in percentage of total stamp duty revenue paid by quintile (percentage points)

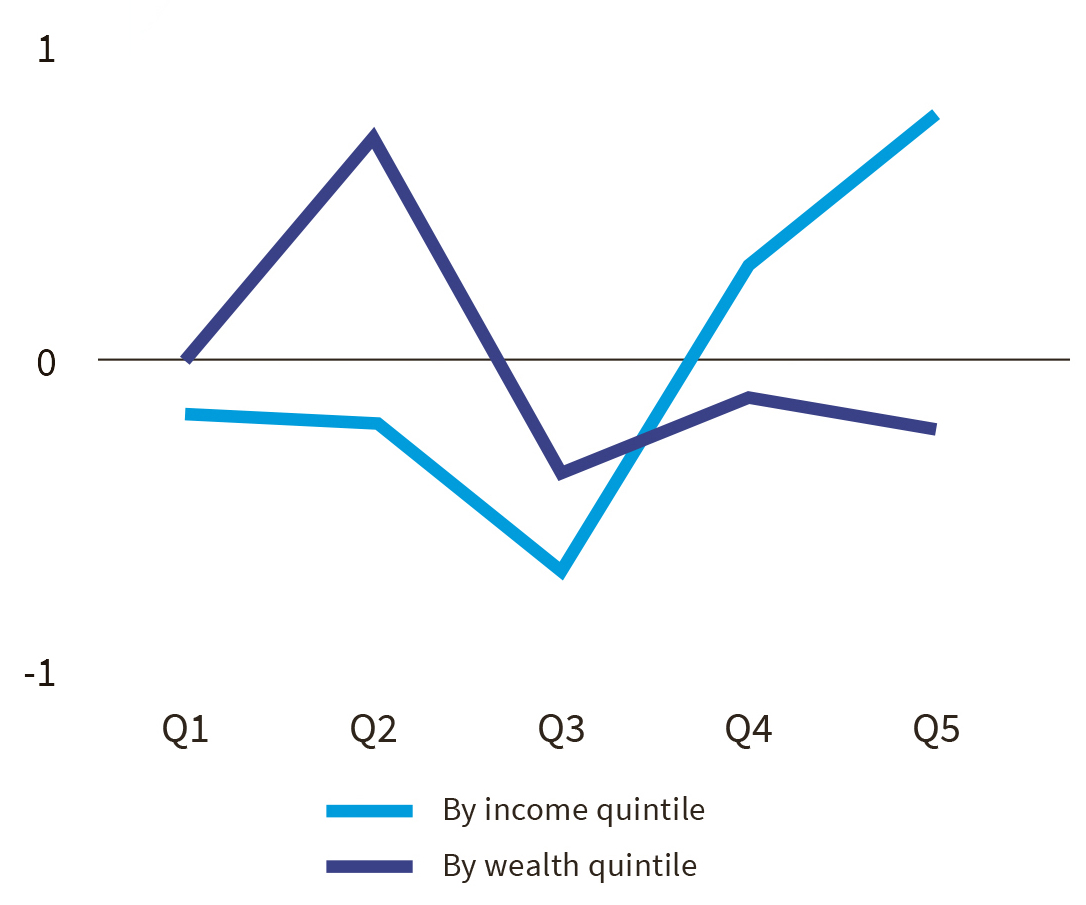

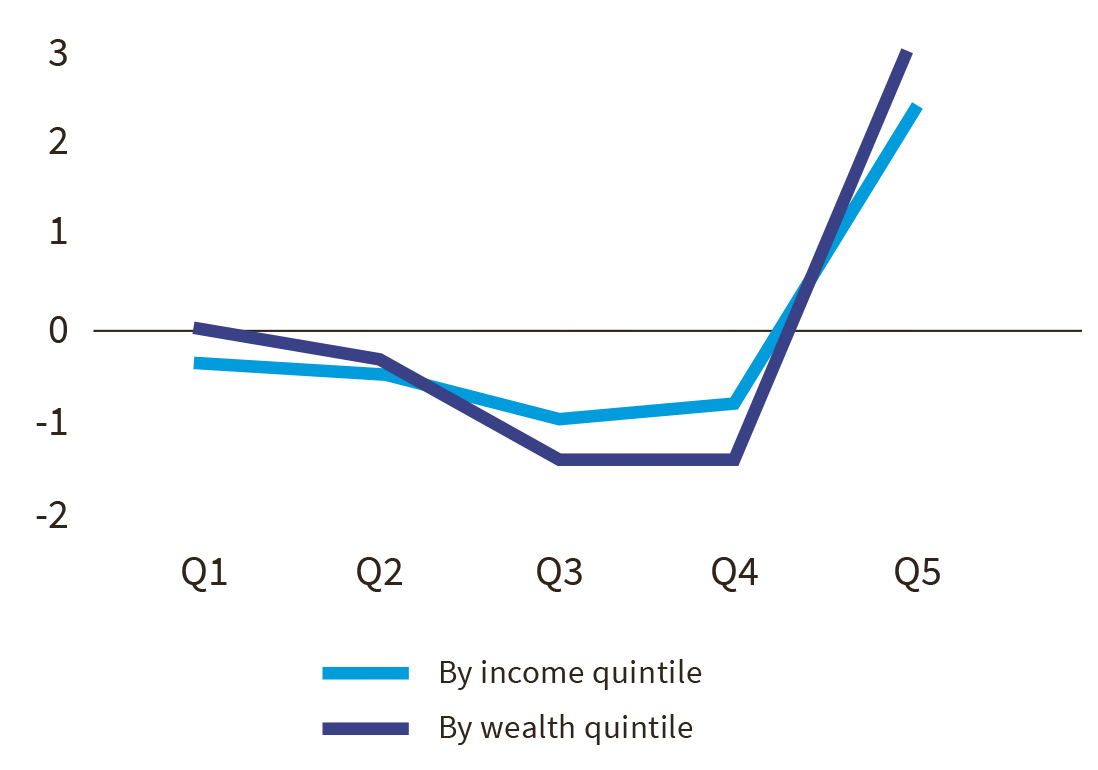

Progressivity and equity - general rates

The general rates system is now more progressive with lower income and wealth households paying a lower proportion of total general rates revenue.

Households in the first four income quintiles (i.e. 80 per cent of households in Canberra) are on average paying a lower proportion of total general rates revenue than they would have in the absence of tax reform.

Change in percentage of total general rates revenue paid by quintile (percentage points)

| Report title | PDF download | DOC download |

|---|---|---|

The economic and efficiency impacts of altering elements of the ACT’s tax mix | PDF 704 KB | DOC 997 KB |

Analysis of the Impacts and Outcomes of the ACT Tax Reform | PDF 3.7 MB | DOC 2.5 MB |

Revenue Forgone from Payroll Tax | PDF 623 KB | DOC 430 KB |

Revenue Neutrality of Tax Reform | PDF 887 KB | DOC 683 KB |

Note: If you have any issues accessing any of the information in the above documents please email Revenue.Policy@act.gov.au.